Title: Unlocking the Benefits of US Bank Small Business Accounts

Introduction:

Small businesses are the backbone of the economy, and managing finances efficiently is crucial for their success. US Bank offers a range of small business account options tailored to meet the unique needs of entrepreneurs. In this comprehensive guide, we will explore the features, benefits, and considerations of US Bank small business accounts, helping you make informed decisions for your business’s financial health.

Types of US Bank Small Business Accounts:

- Business Checking Accounts:

- US Bank offers various business checking account options, including Simple Business Checking, Silver Business Checking, Gold Business Checking, and Platinum Business Checking. Each account comes with different features and fee structures to cater to businesses of all sizes.

- Business Savings Accounts:

- US Bank provides business savings accounts that allow you to earn interest on your idle funds while keeping them accessible for future business needs. Options like Business Savings, Elite Business Savings, and Premium Business Money Market accounts offer competitive interest rates and easy access to funds.

- Merchant Services:

- US Bank’s Merchant Services enable small businesses to accept payments seamlessly, whether in-person, online, or on-the-go. With options like credit card processing, point-of-sale solutions, and virtual terminals, businesses can enhance their payment processing capabilities.

- Business Credit Cards:

- US Bank offers a range of business credit cards designed to meet various business needs, from earning rewards on everyday purchases to managing cash flow effectively. Business owners can choose from cards with low introductory APRs, rewards programs, and expense management tools.

- Convenience and Accessibility:

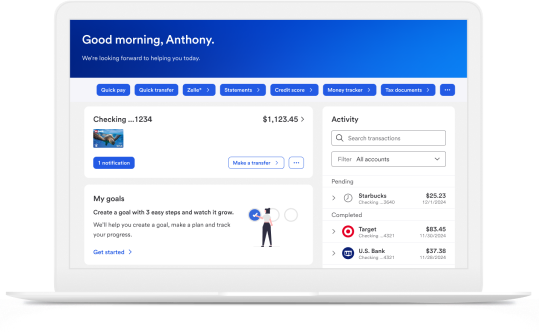

- US Bank’s online and mobile banking platforms make it easy for small business owners to manage their finances anytime, anywhere. Features like mobile check deposit, bill pay, and account alerts provide convenience and accessibility.

- Dedicated Support:

- Small business owners can benefit from personalized support and guidance from US Bank’s team of business banking experts. Whether you have questions about account features or need assistance with financial planning, US Bank is there to help.

- Fraud Prevention:

- US Bank prioritizes the security of its small business customers, offering tools and resources to help prevent fraud and protect sensitive financial information. Features like account alerts, token authentication, and secure payment processing enhance security measures.

- Financial Tools and Resources:

- US Bank provides small business owners with access to a range of financial tools and resources to help them make informed decisions and manage their finances effectively. From budgeting tools to educational resources, US Bank supports business owners in achieving their financial goals.

- Account Fees and Minimum Balance Requirements:

- It’s essential to consider the fees associated with each account type and whether your business can meet the minimum balance requirements to avoid additional charges.

- Account Features and Benefits:

- Evaluate the features and benefits offered by each account type to ensure they align with your business’s needs and goals. Consider factors like interest rates, transaction limits, and online banking capabilities.

- Customer Service and Support:

- Assess the level of customer service and support provided by US Bank, including availability, responsiveness, and expertise in small business banking.

- Integration with Business Tools:

- Determine how well US Bank’s small business accounts integrate with your existing business tools and software to streamline financial management processes.

Benefits of US Bank Small Business Accounts:

Considerations When Choosing a US Bank Small Business Account:

Conclusion:

US Bank small business accounts offer a comprehensive suite of financial products and services designed to help small business owners manage their finances effectively. By understanding the features, benefits, and considerations of US Bank small business accounts, you can make informed decisions that support your business’s growth and success. Take advantage of US Bank’s dedicated support, advanced security measures, and financial tools to unlock the full potential of your business’s financial health.